The $11 Trillion Dividend: Why Employee Thriving is the Ultimate 2025 Competitive Advantage

- Kurt Love

- 6 hours ago

- 5 min read

Posted: 1/28/2026

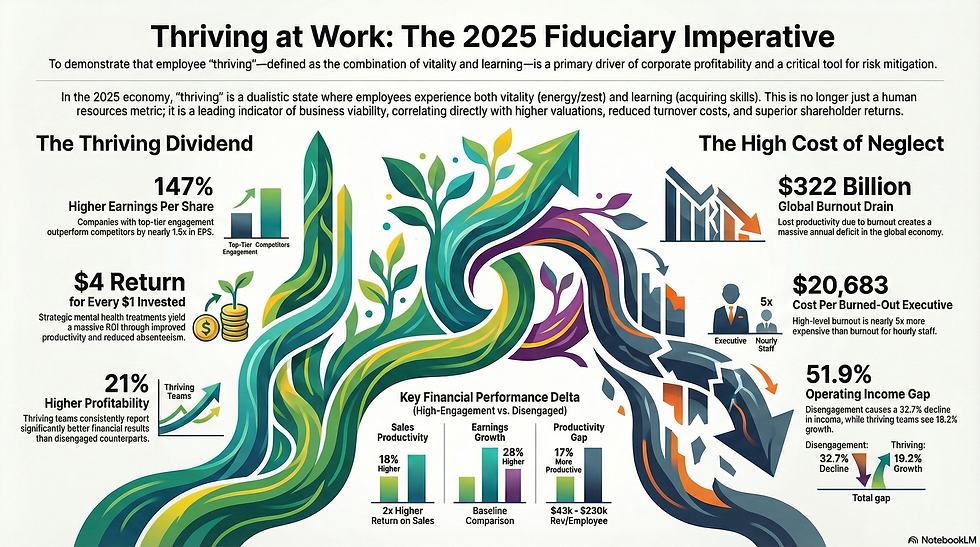

In the fiscal landscape of 2025, the boundary between organizational psychology and corporate finance has effectively dissolved. We have reached a definitive turning point where the psychological state of the workforce is no longer a "soft" HR variable, but a primary fiduciary imperative. For the modern C-suite, employee thriving has emerged as the most reliable leading indicator of long-term valuation and systemic resilience.

To thrive is to operate within a specific psychological state characterized by the dualistic construct of vitality and learning. It is not a static binary of "happy" or "unhappy," but a continuum managed through the Socially Embedded Model (SEM). Vitality provides the essential "zest" and available energy for work, while learning provides the cognitive confidence and capability resulting from the acquisition of knowledge.

When these two dimensions align, they create a self-reinforcing cycle of growth. For the Chief Financial Officer, this isn't just about morale; it is about the "thriving dividend"—the measurable financial surplus generated when an organization stops merely consuming human capital and starts cultivating it as a renewable asset.

The Formula for Thriving: Beyond the Burnout Trap

Thriving is the synergy of affective energy and cognitive progress. If an employee is acquiring new skills but feels physically and emotionally depleted, they aren't thriving; they are caught in a "burnout trap" that precedes a total performance collapse. Conversely, energy without learning results in stagnation—a workforce that is busy but functionally obsolete.

As established by the Socially Embedded Model, thriving is fueled by unit contextual features: decision-making discretion, information sharing, and a climate of trust. When these features are present, employees engage in agentic work behaviors, creating a "joint sense of vitality and learning" that signals they are moving forward in their self-development.

"Thriving represents the 'joint sense of vitality and learning,' which communicates to the individual that they are moving forward in their self-development."

The Billion-Dollar Happiness Score: Quantifying the Well-being Dividend

The financial delta between a thriving workforce and a stagnating one is staggering. Data from the McKinsey Health Institute indicates that holistic investments in employee well-being could generate between $3.7 trillion and $11.7 trillion in global economic value—a potential boost to global GDP of up to 12%.

For individual large-scale firms, the correlation is granular and immediate: a one-point increase in employee happiness scores is associated with a $1.39 billion to $2.29 billion increase in annual profits. Investors are increasingly weighting these metrics, as evidenced by the performance of the "Wellbeing 100":

Market Outperformance: A stock portfolio of the top 100 companies for employee well-being has significantly outperformed major stock market indices since 2021.

Shareholder Returns: High-engagement companies deliver seven times greater shareholder returns over a five-year period compared to low-engagement peers.

Management Quality Proxy: Thriving metrics are now viewed by analysts as a proxy for management quality and organizational resilience, particularly during economic downturns.

The "Cost of Silence" and Psychological Safety as Risk Management

Psychological safety—the belief that one can speak up without fear of humiliation—is 2025’s most undervalued risk management tool. It functions as an organizational "early warning system." The "cost of silence"—the warnings about data breaches, product defects, or safety violations that remain unspoken—is a direct drain on capital.

Failing to foster this environment contributes to a $322 billion annual drain on the global economy in lost productivity. Beyond preventing catastrophe, psychological safety serves as a buffer against resource scarcity. Even when staffing or tools are inadequate, employees in safe environments report a higher intent to stay and a reduction in burnout (a decrease of 0.72 points on the burnout scale). Silence isn't just a cultural flaw; it is a persistent fiduciary breach.

Flexibility as a Profitability Catalyst (Not a Perk)

The transition to hybrid work is an exercise in margin preservation. 79% of flexible businesses report significant cost savings through reduced overhead. However, the true gain is in human capital efficiency: flexible arrangements have driven a 19% increase in productivity, equivalent to an additional 7.6 hours per week per worker.

From a talent acquisition perspective, flexibility is a powerful financial lever. 63% of employees would accept a pay cut for the option to work remotely, allowing organizations to maintain more efficient compensation structures while attracting top talent. Furthermore, hybrid models have been shown to reduce quit rates by one-third (33%). When you consider that turnover costs are conservatively estimated at 33% of an employee’s base pay, the ROI of flexibility becomes an undeniable mathematical certainty.

The Staggering ROI of Mental Health Intervention

Mental health is a core business concern. Depression and anxiety cost the global economy $1 trillion annually, much of it through "presenteeism"—where employees are physically present but functionally unproductive, reducing individual output by up to 34%.

Investing in treatment is not discretionary; it is high-yield. For every $1 invested in mental health treatments, organizations expect a $4 return. To understand the "capital leak" of ignoring this, consider the annual cost of a single burned-out employee:

Executive: $20,683 per year.

Hourly Staff: $3,999 per year.

For a 1,000-employee firm, this represents a $5 million annual loss—a cost that is 3.3 to 17.1 times higher than the cost of training a replacement.

"Mental health is a core business concern rather than a discretionary expense; strategic programs maintained for over three years show a median yearly ROI of $2.18 for every dollar spent."

The 147% Earnings Advantage: The Service-Profit Chain

The "Service-Profit Chain" provides the ultimate evidence of the link between internal energy and external earnings. High-engagement teams outperform their competitors by 147% in earnings per share (EPS). The disparity in operating income is even more profound: while high-engagement teams see an average 19.2% increase in operating income, low-engagement teams experience a 32.7% decline—a 51.9 percentage point delta.

This performance is sustained by "earned" loyalty. In service firms, where value is co-produced between employees and customers, loyalty must be earned through high-quality, high-vitality interactions. This "earned" loyalty leads to reduced operating costs and more stable revenue compared to product firms that often "buy" loyalty through margin-eroding promotions. Thriving employees are 40% more likely to exert discretionary effort, resulting in a 10% boost in customer ratings (CSAT) and 23% higher profitability.

Conclusion: The Bottom Line Follows the Human Truth

Capturing the "thriving dividend" requires a "Portfolio Approach" to culture. This includes moving beyond annual reviews to frequent, development-focused conversations, institutionalizing autonomy, and taking visible, aggressive steps to excise toxic behaviors.

The data-driven reality of 2025 is simple: the health, energy, and growth of your workforce are the primary drivers of your financial results. Disengagement is not an HR headache; it is a massive capital leak that destabilizes your balance sheet and destroys shareholder value.

In a world of volatility, the most resilient asset you own is the collective vitality of your people. The evidence is in: when people thrive, the bottom line follows. The only question remaining is: are you managing your human capital with the same rigor as your financial capital, or are you letting the $11 trillion dividend slip through your fingers?

Comments